Is ETH Deflationary?

Ethereum will be upgraded for the first time in 2023 on April 12th, but it has undergone several successful upgrades over the last 2 years that has greatly changed its supply and tokenomics. Two major milestones have been reached in the Ethereum roadmap over the last year and a half, the Burn and the Merge.

The first major change was in Aug of 2021, when EIP-1559 was implemented. This was the first time ETH as a part of its fee mechanism was burnt in every Ethereum transaction. This meant with every transfer, swap or nft purchase a portion of the gas fee paid in ETH was burnt and lowered the supply of ETH on chain. Until this point, ETH miners we creating an almost limitless number of ETH each time a block was secured on the network. Unlike Bitcoin, Ethereum doesn’t have a hard cap on its supply, but at least with the advent of the burn, the supply was growing more slowly.

In Aug. of 2021 we were in the middle of a massive bull market. Opensea was making major waves not only in the crypto space, but their top sellers like Crypto Punks and Board Apes were spilling over into mainstream headlines. This phenomenon created so much buzz and hype that the Ethereum blockchain was practically overheating with transaction volume. The price of ETH was nearing all-time-highs over $4000 per ETH, but the cost of a transaction was often over $100 during peak hours. The burn mechanism was destroying thousands of ETH every day, yet the miners were mining ETH at such a pace that they still grew the supply at a rather predictable linear rate. The growth of the supply had slowed, but was far from deflationary.

The bull market came to a screeching halt in Dec of 2021 and lead to a massive pull back in the price of ETH and consequently traffic on the network also slowed. Miners kept mining, in fact with the Ethereum merge on the horizon many were doubling their efforts, while others sold their mining equipment and spun up validators. The merge was coming and that would mean the end of proof-of-work and another major change to the ETH supply. The ETH supply continued to grow, but not for long.

In sept of 2022 after many months of testnet iterations were conducted, the merge was completed on mainnet. ETH maxis were overjoyed with the completion of a massive achievement not attempted by any other network before. The poof-of-work chain was merged with the proof-of-stake chain which meant that mining would sees and the only supply growth on chain would be provided by the proof-of-stake validators at a rate much lower than that of proof-of-work.

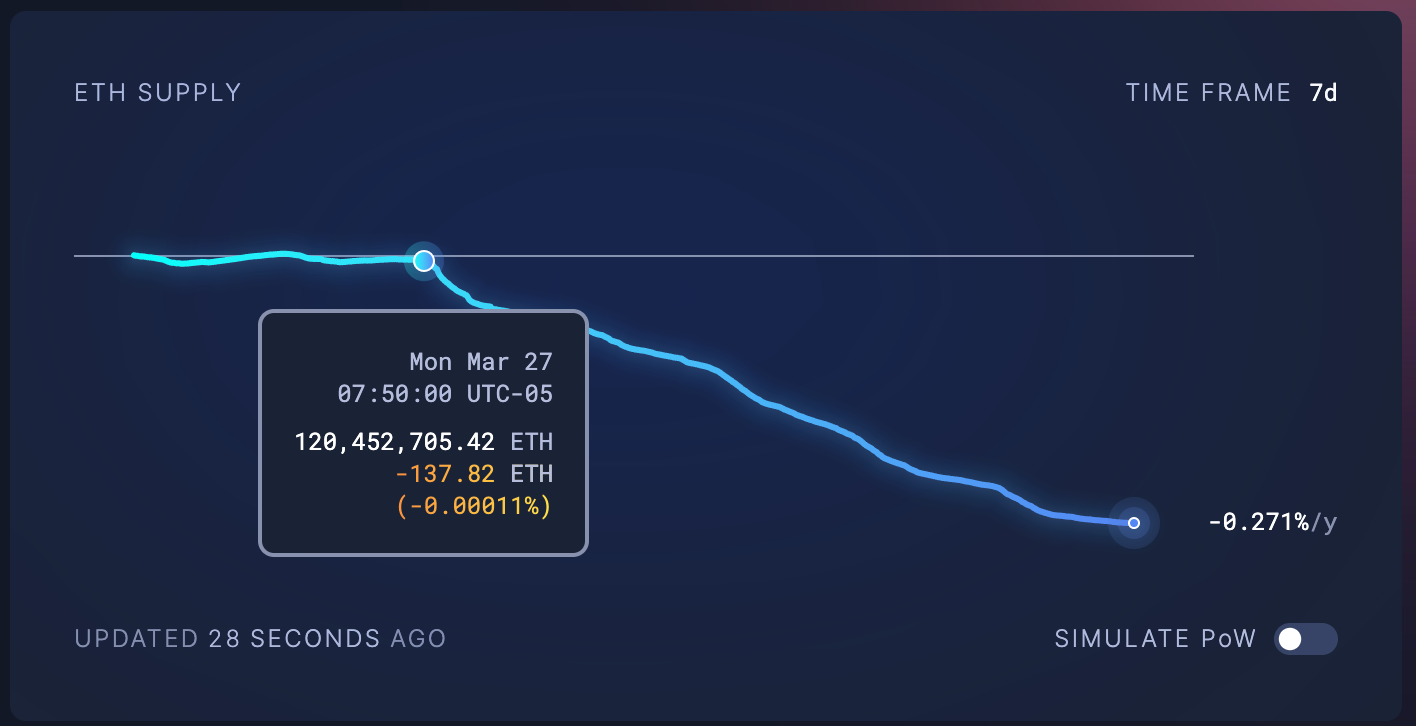

Since the merge, the slow in the supply growth of validators along with the burn has lead to a steady decrease in the overall ETH supply. In fact, since march of 2022, the ETH supply has become deflationary. As long as the burn continues to outpace the relatively small supply growth, ETH will continue to be deflationary. As we head into another bitcoin halving and the potential for another bull market in 2024, traffic on the network will likely only grow. With more traffic, there will be more ETH burnt and the rate of delation could quicken.

In my opinion this is extremely bullish for the price of ETH as we near 2024. As supply decreases and demand increases, in theory, we could have even greater price appreciation on the Ethereum network this cycle. If you’re an ETH investor like myself and like this content, please follow me on twitter @AllThingsETH or on YouTube. Have a great week and God bless!

![How To Use Bitget Exchange To Buy Bitcoin and Crypto [2022]](https://cryptosrus.com/wp-content/uploads/2022/07/Untitled-design-23-300x166.png)

![Bitcoin [BTC], Gold, S&P 500 and a case of the widening correlation](https://www.blocpress.com/wp-content/uploads/2023/03/chart-1905225_1920-1000x600-120x86.jpg)